OTTAWA — Canada’s four western provinces are expected to experience volatile construction labour demand in the next 10 years with even British Columbia, predicted to be a powerhouse construction job creator over that period, set to endure job setbacks in the middle of the decade.

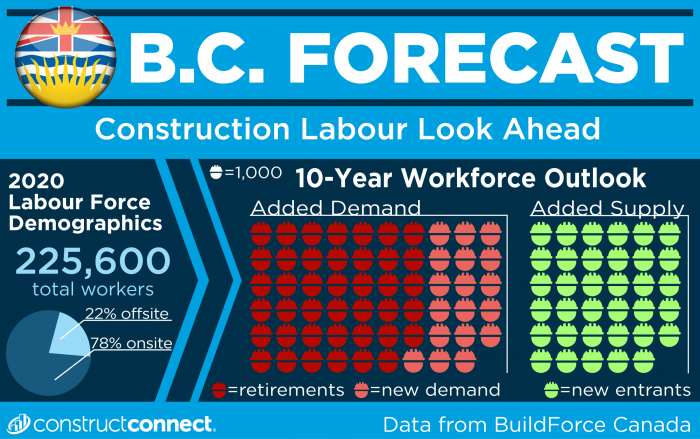

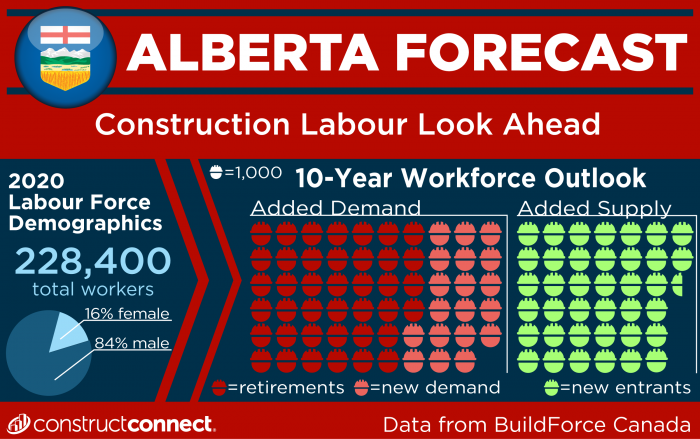

The forecasts for the provinces come from BuildForce Canada’s 2021–2030 Construction and Maintenance Looking Forward national report, released the week of March 22. BuildForce anticipates that construction employment will rise nationally by 64,900 workers over the next decade. This represents an increase of six per cent over 2020 workforce levels.

Alberta will lead growth in non-residential construction jobs in the next five years with a spike of 10 per cent, followed by British Columbia, with growth expected to reach eight per cent. Saskatchewan follows with a forecasted hike of four per cent while Manitoba will suffer through construction job losses of eight per cent in the next five years.

In 2020, Manitoba experienced its first year of negative construction growth in several years. BuildForce suggested that declines in major project requirements, alongside lower anticipated levels of institutional building and new-home construction, could limit employment growth for much of the decade. Modest growth in road, highway and bridge construction, industrial buildings and other infrastructure projects is expected to partially offset these declines. By 2030, industry employment will be marginally lower, reduced by approximately one per cent from 2020 levels.

1/2

2/2

“Manitoba is coming off the peak of an extended construction expansion that was fuelled by electrical power generation and transmission, pipeline and infrastructure projects, and immigration-driven population growth over the last decade,” said BuildForce executive director Bill Ferreira in a release. “The industry added more than 12,000 new workers, or about one-third of its total workforce, over that period.

“With several of those large projects concluding in 2020, and a slowdown in the residential construction industry, the province’s workforce is expected to contract in the short term before rising again after 2025.”

预计将在广泛的复苏Saskatchewan in 2021 as education, health care, utility and mining investment combine to boost growth across most construction segments to an expected peak in 2023.

We expect growth to return in 2021 with the stacking of projects across nearly every sector of the industry,

— Bill Ferreira

BuildForce Canada

Industry employment declined in 2020 due to the COVID-19 pandemic, with the commercial and industrial building and engineering sectors most affected.

“The anticipated recovery follows several years of steady declines in Saskatchewan’s construction market and continued weaker conditions in 2020 that contributed to elevated rates of unemployment,” said Ferreira. “Although the moderate pace of projected growth suggests that demands are likely to be met locally, challenges may arise for key trades during peak periods.”

Alberta, which was among the provinces hardest hit by the pandemic, could see further challenges ahead. Ongoing uncertainty in the energy sector and further deferrals and cancellations of major investments have significantly tempered expectations for a strong near-term recovery.

A more material expansion is expected after 2023 on the strength of anticipated investments in oil and gas projects as well as an upcycle in new residential construction.

British Columbia is poised to enter the steepest period of growth in its forecast period. The province will add more than 11,400 non-residential workers through 2022, before shedding as many as half of those gains through 2026, before renewed growth later in the period adds new jobs. By 2030, employment is expected to increase by 9,900 workers compared to 2020.

B.C. was also hit hard by COVID in 2020. The province saw declines in new housing, commercial and industrial building construction, which experienced double-digit declines in investment compared with 2019.

Those losses were partially offset by a rise in demands from major engineering and pipeline projects, as well as numerous public-transportation projects.

“The slowdown in construction and maintenance activity in British Columbia last year may have been seen by some as a blessing, as the province’s labour market has experienced chronic recruiting challenges,” said Ferreira. “Having said that, the brakes won’t be on for long. We expect growth to return in 2021 with the stacking of projects across nearly every sector of the industry — heavy industrial, public transit, education, health care, public infrastructure projects, as well as new housing, renovation work and commercial building construction. This could create significant recruiting challenges across the industry.”

Recent Comments

comments for this post are closed